New Mexico Debt Relief

Reduce Your Credit Card Debt By Up To Half

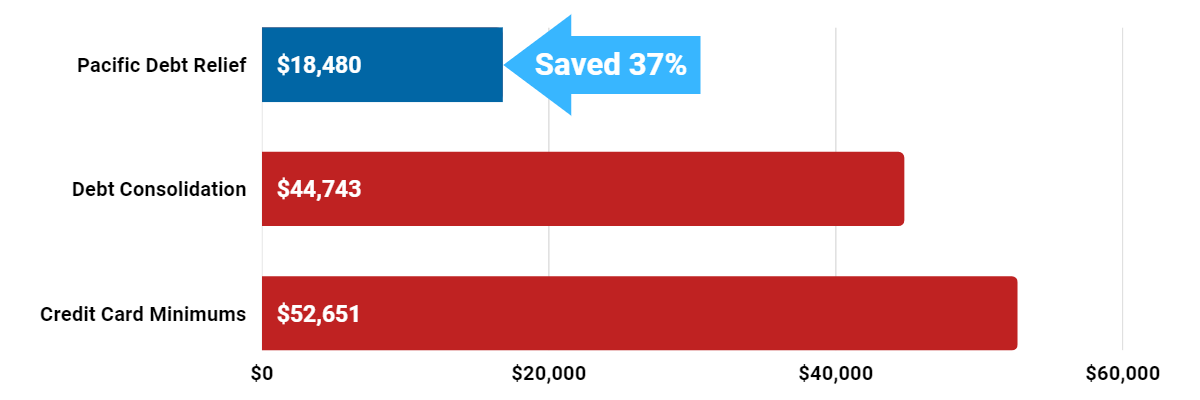

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

New Mexico Debt Relief Reviews

New Mexico Debt Relief Testimonials

New Mexico Better Business Bureau

Pacific Debt Relief is an A+ rated business with the BBB. We have been accredited since 2010. We have received 4.87 out of five stars based on 40 customer reviews with the BBB.

Get a FREE consultation today with no obligation. We will help you understand all your debt relief options.

The State of New Mexico

New Mexico, the Land of Enchantment, ranges from desert to tall mountains. The economy is based on oil and gas production, tourism, and federal government spending. New Mexico is ranked #36 for population and #45 for population density.

As of 2018, over 2,090,708 people called New Mexico home. Albuquerque is the largest city in New Mexico.

Income

The median state income is $46,748. As of 2018, the minimum wage is $7.50 per hour, although it may be slightly higher depending on your employment. Unfortunately, 29.9% of New Mexican children under 18 live in poverty. This is the highest in the nation. For residents overall, 19.8% of all people in New Mexico live under the poverty level – third highest in the US.

- Median state income: $46,748

- Minimum wage: $7.50/hour

- Children in poverty: 29.9%

- People in poverty: 19.8%

Is New Mexico a Community Property State?

New Mexico is a community property state. Therefore your assets are seen as equally owned by you and your spouse. Currently, there are only 10 states that are community property states. In the state of New Mexico, the judge will decide which assets are shared by you and your spouse, and what the equity is for each.

There are 10 community property states in which the state sees your assets as community property are Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada,

New Mexico, and Wisconsin.

Homeowners & New Mexico Residents

More than half (66.6%) of New Mexicans hold a mortgage. The median home price in New Mexico is $227,000 (2018). Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 66.6%

- Median home price: $227,000

Employment

New Mexico has a current unemployment rate of 5.6%. The underemployment rate is 12.6%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time or are not seeking employment.

If this is you, we can help. Pacific Debt offers New Mexico debt relief solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 5.6% (2018)

- Underemployment: 12.6% (2017)

New Mexico Debt

New Mexicans carry a lot of debt. The average credit card debt is $7,952 (2018). The average student loan debt is $20,193. When you add all that debt on top of the cost of homes (rental or owned), versus the median income, it is very easy for New Mexicans to get into debt.

- Avg credit card debt: $7,9528 (2018)

- Avg mortgage debt: $159,458 (2017)

- Avg student loan debt: $20,193 (2017)

New Mexico Statute of Limitations

New Mexico’s statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in New Mexico, the following are the statutes of limitations for different types of debt.

- Oral agreements: 4 years

- Written contracts: 6 years

- Promissory notes: 6 years

- Credit cards and other revolving loans: 4 years

New Mexico Debt Relief & Debt Consolidation

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt free. Since 2002, we’ve settled over $200 million in debt for thousands of clients. We are a nationally top ranked debt relief company located in San Diego.

We will help you work through our proven and comprehensive debt relief program. Your certified debt relief counselor will review all your options. If debt settlement is right for you, we move forward with our debt consolidation program and work to save you money. Pacific Debt can help with most unsecured debt like credit cards, personal loans, medical bills, and repossessions.

It is not an easy process and it won’t happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

Debt Collection Laws

New Mexicans are protected against unscrupulous debt collectors. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive or harassing bill collection practices. In addition, the New Mexico Fair Debt Collection Practices Act (NMFDCPA) adds protections against more types of collectors and actions. If you are a victim of any of these actions, you may take legal action against them.

Overall, debt collectors can NOT:

- Charges more than 10% interest

- Garnish more than 25% of wages

- U se/threaten physical force or criminal tactics to harm you, your property, or your reputation

- Accusing you of committing a crime for not paying the debt

- Make/threaten to make defamatory statements to someone else

- Threaten arrest, to seize assets, or garnish wages unless actually planning to take such action

- Use obscene or profane language

- Cause you to spend money you wouldn’t otherwise have spent (ie long-distance telephone calls)

- Call you repeatedly or let your phone ring repeatedly

- Call frequently

- Contact your employer, except to verify employment or health insurance status, garnish wages or locate you

- Reveal information about debt to anyone except your spouse or your parents if a minor.

- Publicly publish your name for failing to pay

- Send a postcard or letter with revealing information on the envelope

- Claim to be someone other than a debt collector, including a governmental official

- Use stationery that appears to be from a law firm

- Charge you collection or attorney’s fees unless legally allowable

- Threaten to report you to a credit reporting agency if they have no intention of doing so

- Send a letter claiming to come from a claim, credit, audit, or legal department unless it actually is

Debt collectors must:

- Disclose caller identification

- May contact your family to locate you

- Must serve you with notice of a lawsuit if suing you

Bankruptcy Court Information

Bankruptcy is a legal action that can erase most of your debt as well as your credit history. It is not an action to take lightly. If you do, you must follow the following steps in New Mexico.

Persons filing for bankruptcy must:

- Complete credit counseling within six months before filing for bankruptcy.

- Complete a financial management instructional course after filing bankruptcy.

- Complete a Bankruptcy Act Means Test to determine if you are eligible for a Chapter 7 or 13 bankruptcy

- Itemize current income sources; major financial transactions; monthly living expenses; debts (secured and unsecured); and property (all assets and possessions, not just real estate).

- Collect last 2 years of tax returns, deeds to real estate you own, car titles, and loan documents

- File for bankruptcy

- Chapter 7 bankruptcy fee is $306

- Chapter 13 bankruptcy fee is $281

- Meet with court assigned bankruptcy trustee

- Attend a Meeting of Creditors

- Confirm plan if filing for Chapter 13 bankruptcy

Pacific Debt Provides Debt Relief For New Mexico Cities

Acomita Lake

Albuquerque

Anthony

Beclabito

Bloomfield

Canada de los Alamos

Carlsbad North

Causey village

Chamisal

Chupadero

Cloudcroft village

Corona village

Cuartelez

Deming

Dora village

El Cerro-Monterey Park

El Rancho

Espanola

Flora View

Galisteo

Grants

Hobbs

Huerfano

Jal

Kirtland

Lake Arthur

La Puebla

Lordsburg

Los Lunas village

Lovington

Maxwell village

Mesilla

Moriarty

Nakaibito

Nenahnezad

Yellow Eye

Pena Blanca

Pinehill

Portals

Radium Springs

Red River

Rio Chiquito

Rio Lucio

Roy village

San Felipe Village

Sanostee

Santa Cruz

Santo Domingo Village

Shiprock

Sombrillo

Tajique

Tatum

Scissors village

Torreon CDP (Sandoval County)

Tucumcari

Upper Fruitland

Vaughn

White Sands

Zia Village

Agua Fria

Mayor

Artesia

Belen

Boles Acres

Cannon AFB

Carnuel

Cedar Crest

Chaparral

Church Rock

Clovis

Corrales village

Cuba village

Des Moines village

Dulce

Eldorado at Santa Fe

The Valley of Arroyo Seco

Estancia

Floyd village

Gallup

Grenville village

Holloman AFB

Hurley

Jarales

La Cienega

Lake Sumner

Las Cruces

Los Alamos

Los Ranchos de Albuquerque village

Madrid

Meadow Lake

Coffee table

Mosquero village

Napi HQ

Newcomb

Paguate

Penasco

Plazas

Village of Sandia Village

Ramah

Regina

Rio Communities

Rio Rancho

Ruidoso village

San Ildefonso Village

Santa Ana Village

Santa Fe

San Ysidro village

Silver City

South Valley

Taos

Tesuque

Timberon

Torreon CDP (Torrance County)

Tularosa village

Vadito

Virden village

Willard village

Zuni Village

Alamo

Algodones

Aztec

Bernalillo

Forest Farms village

Capitan village

Carrizozo Red

Cedar Grove

Chilili

Cimarron village

Cochiti

Crownpoint

Cundiyo

Dexter

Eagle Nest village

Elephant Butte

Encinal

Eunice

Folsom village

Glorieta

Hagerman

Hope village

Isleta Village Proper

Jemez Pueblo

Laguna

La Luz

Las Vegas

Los Cerves

Los Trujillos-Gabaldon

Magdalena village

Melrose village

Mesquite

Mountainair

Naschitti

North Acomita Village

Place

Peralta

Pojoaque

Painted Village

Taos Ranches

Reserve

Rio Communities North

Rock Springs

Ruidoso Downs village

San Jon village

Santa Clara village

Santa Rosa

Seama

Skyline-Ganipa

Springer

Taos Village

Texico

Tohatchi

Truth or Consequences

Twin Lakes

Vado

Wagon Mound village

Williamsburg village

Alamogordo

Angel Fire village

Bayard

Black Rock

Brimhall Nizhoni

Carlsbad

House

Chama village

Chimayo

Clayton

Columbus village

Crystal

Cuyamungue

Dona Ana

Edgewood

Elida

Encino village

Farmington

Fort Sumner village

Grady village

Hatch village

House

Jaconita

Jemez Springs village

La Jara

Lamy

Logan village

Los Chaves

Loving village

Manzano

Mescalero

Milan village

Nageezi

Navajo

North Valley

Pecos village

Picuris Village

Ponderosa

Questa village

Raton

Rincon village

Rio in the middle

Roswell

Salem

San Juan

Santa Clara Village

Santa Teresa

Sheep Springs

Socorro

Sunland Park

Taos Ski Valley village

Thoreau

Tome-Adelino

Tse Bonito

University Park

Valencia

White Rock

Yah-ta-hey

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information